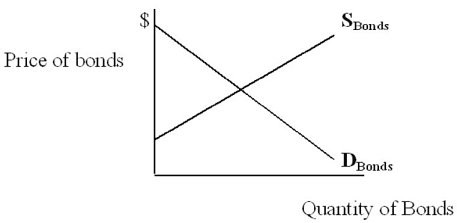

Notice the following model of a bond market. In each situation given, explain what happens to the bond price and yield and why.  a) Expected inflation increasesb) The return on bonds rises relative to other assetsc) The federal government deficit increases

a) Expected inflation increasesb) The return on bonds rises relative to other assetsc) The federal government deficit increases

What will be an ideal response?

a) If expected inflation increases the demand for bonds will decrease and the supply will increase. Both of these will reinforce each other, causing the bond prices to fall and interest rates to increase.

b) If the return on bonds rises relative to other assets, the bond demand curve will shift to the right, causing bond prices to increase and interest rates to decrease.

c) If the federal budget deficit increases, the bond supply curve will shift to the right, causing the bond prices to fall and interest rates to increase.

Economics