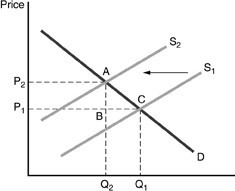

Refer to above figure in which negative externality existed. The government imposes a $1.00 pollution tax on the producer. Supply shifts leftward.

Refer to above figure in which negative externality existed. The government imposes a $1.00 pollution tax on the producer. Supply shifts leftward.

A. This tax will be borne entirely by the producer.

B. The amount of the tax shifted to the consumer depends on the consumer's elasticity of the demand curve.

C. This tax will be shifted entirely to the consumer.

D. The tax will be divided into equal amounts between consumer and producer.

Answer: B

You might also like to view...

Which of the following is an appropriate policy for the Fed to pursue if it wants to increase the money supply?

A) lower taxes B) raise the reserve requirement C) buy U.S. Treasury bills D) raise the discount rate

Suppose that you expect during the next year the dollar will appreciate against the pound from 0.5 pound to the dollar to 0.75 pound to the dollar

How much will you expect to make on an investment of $10,000 in British government securities that will mature in one year and pay interest of 8%? A) -59.5% B) -28% C) 8% D) 28%