Which of the following statements about the ripple effects of monetary policy is FALSE? Monetary policy can

A) raise the federal funds rate, thereby decreasing the quantity of money, raising the real interest rate, and decreasing investment.

B) lower the federal funds rate, thereby increasing the supply of loanable funds, and lowering the exchange rate.

C) lower the federal funds rate, thereby lowering the real interest rate and increasing aggregate demand.

D) raise the federal funds rate and shift the aggregate demand curve leftward.

E) raise the federal funds rate, thereby raising the real interest rate and increasing potential GDP.

E

You might also like to view...

Tax revenue

What will be an ideal response?

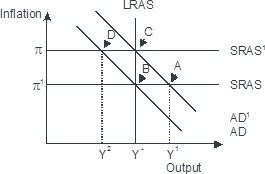

Based on the figure below. Starting from long-run equilibrium at point C, a tax increase that decreases aggregate demand from AD1 to AD will lead to a short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________, if left to self-correcting tendencies.

A. D; C B. D; B C. A; B D. B; C