The Fed increases the quantity of money to counteract

A) a federal budget surplus.

B) an inflationary ga

E

You might also like to view...

Assume that the current one-year rate is 3% and the two-year rate is 5%. Given this information, the one-year rate expected one year from now is

A) 5%. B) 6%. C) 7%. D) 9%. E) 12%.

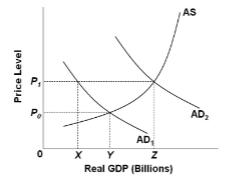

Refer to the figure. Suppose that the economy is currently operating at the intersection of AS and AD 2 , and that the full-employment level of output is Y. Because of the ratchet effect:

A. it is impossible to enact fiscal policy that will both reduce output to Y and reduce demand-

pull inflation.

B. fiscal policy will need to be more contractionary to reduce output to Y than if no ratchet

effect occurred.

C. tax increases will be more effective at reducing demand-pull inflation than cuts in

government spending.

D. contractionary fiscal policy that shifts aggregate demand to AD 1 will cause real GDP to fall below its full-employment level.