The idea that individuals should be taxed in proportion to the marginal benefits that they receive from public goods is called

A) the horizontal-equity principle. B) the ability-to-pay principle.

C) the benefits-received principle. D) the vertical-equity principle.

C

Economics

You might also like to view...

An autonomous tightening of monetary policy

A) causes an upward movement along the monetary policy curve. B) causes a downward movement along the monetary policy curve. C) shifts the monetary policy curve upward. D) shifts the monetary policy curve downward.

Economics

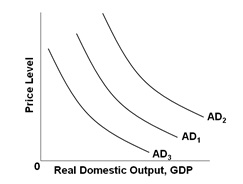

What combination would most likely cause a shift from AD1 to AD3?

Refer to the above graph.

A. An increase in taxes and an increase in government spending

B. A decrease in taxes and an increase in government spending

C. An increase in taxes and a decrease in government spending

D. A decrease in taxes and a decrease in government spending

Economics