Consider voter preferences over a public good y that is being funded by a proportional income tax.

a. Illustrate how this might lead to single peaked voter preferences.

b. Suppose there exists a privately available good x that is substitute for y. How does this introduce non-single peakedness?

c. Now suppose x is relatively complementary to y. What would you expect to happen to voter preferences as this complementarity gets stronger?

What will be an ideal response?

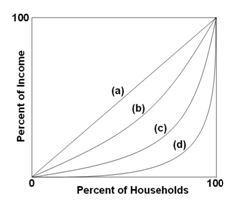

a. This is discussed in Graph 28.1 of the text.

b. This is discussed in Graph 28.3 of the text.

c. The more complementary x is to y, the less likely it is that preferences will be non-single peaked.

Economics